Rumored Buzz on Insurance

Wiki Article

Things about Insurance

Table of ContentsSome Known Factual Statements About Insurance A Biased View of InsuranceNot known Factual Statements About Insurance Rumored Buzz on InsuranceThe 30-Second Trick For InsuranceUnknown Facts About InsuranceThe smart Trick of Insurance That Nobody is Talking AboutExcitement About Insurance

Coverage under PIP differs by state. Almost every state requires motorists to carry responsibility protection, numerous individuals drive without it.This insurance coverage kicks in if you obtain struck by an uninsured chauffeur or a motorist whose plan limits are too low to cover your expenses.

One more aspect to take into consideration is the price of your car. If you could not manage to fix or change it, keeping crash insurance coverage can help get you back on the road if it's harmed in a crash. And also if you stay in a location with frequent serious weather condition or high rates of theft and also criminal damage, having thorough will aid protect you.

Things about Insurance

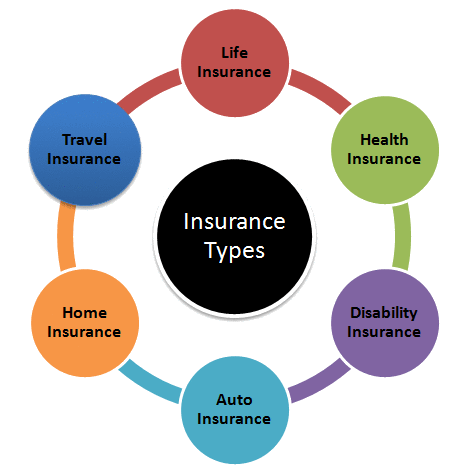

Brokers can aid you assess other plans to make a decision which is finest for your demands. Restricted agents help a solitary insurance firm. They can assist you explore the various sorts of protection a single insurance provider offers and also act as your factor of call if you buy a plan. Unfortunately, they can not help you contrast policies from various companies.Life Insurance, Life insurance policy is different from other insurance policy in the sense that, here, the subject matter of insurance policy is the life of a human being. The insurance firm will pay the fixed amount of insurance policy at the time of fatality or at the expiry of a specific duration. Today, life insurance policy appreciates optimum range because life is the most crucial residential property of a person.

This insurance offers defense to the family at the premature death or provides an appropriate quantity at the seniority when earning capacities are minimized. Under individual insurance policy, a settlement is made at the crash. The insurance is not only a security however is a type of financial investment since a particular amount is returnable to the insured at the death or the expiration of a duration.

Our Insurance PDFs

Fire as well as Marine Insurances are strictly called Residential property Insurance. Motor, Theft, Integrity and also Device Insurances include the extent of responsibility insurance coverage to a specific extent. Connected: The most strict form of liability insurance policy is fidelity insurance policy, where the insurance company makes up the loss to the insured when he is under the responsibility of repayment to the 3rd party.Previously just certain nominal threats were guaranteed now the extent of aquatic insurance coverage had actually been separated right into 2 parts; Sea Marine Insurance and Inland Marine Insurance Policy. The previous guarantees just the aquatic risks while the last covers inland perils which may arise with the distribution of cargo (gods) from the go-down of the insured and also might prolong up to the invoice of the freight by the purchaser (importer) at his drop.

In the absence of fire insurance policy, the fire waste will enhance not just to the private however to the culture. With the assistance of fire insurance coverage, the losses occurring due to fire are compensated and also the culture is not shedding much. The person is liked from such losses and his residential or commercial property or organization or market will certainly continue to be roughly in the same setting in which it was prior to the loss.

An Unbiased View of Insurance

can be insured under this insurance coverage, as well. Obligation Insurance coverage, The general Insurance coverage likewise includes liability insurance whereby the insured is liable to pay the damage of home or to make up for the loss of personality; injury or death. Insurance. This insurance is seen in the kind of integrity insurance coverage, car insurance coverage, and machine insurance policy, and so on.This web page offers a reference of insurance policy terms as well as definitions that are generally used in the insurance company. New terms will be added to the glossary gradually. The meanings in this reference are created by the NAIC Research Study and Actuarial Department staff based upon different insurance coverage referrals. These interpretations represent a typical or basic use the term.

Getting The Insurance To Work

These are a liability to the business and not consisted of in written premium or the unearned premium reserve. - the social phenomenon whereby individuals with a higher than ordinary probability of loss look for higher insurance protection than those with much less risk - Insurance. - a team supported by participant companies whose function is to gather loss stats and also release trended loss costs.- an estimate of the claims settlement connected with a certain insurance claim or insurance claims. - an insurer created according to the legislations of an international nation. The company must satisfy state regulative criteria to legally sell insurance coverage items because state. - coverages which are normally composed with residential or commercial property insurance coverage, e.

- a yearly record More hints required to be submitted with each state in which an insurance provider does service. This record provides a snapshot of the economic problem of a company and also significant events which took place throughout the reporting year. - the beneficiary of an annuity payment, or person during whose life and also annuity is payable.

This page supplies a reference of insurance terms as well as interpretations that are typically used in the insurance coverage business. New terms will certainly be included to the reference over time. The meanings in this glossary are developed by the NAIC Research and also Actuarial Division staff based upon numerous insurance references. look at these guys These meanings stand for a typical or general use the term.

Kinds of coverage consist of pupil crash, sports crash, travel mishap, covering accident, details mishap or unintentional death and dismemberment (AD&D). - unexpected injury to a person. - an insurance policy agreement that pays a mentioned advantage my review here in the occasion of death and/or dismemberment brought on by accident or specified kinds of accidents.

Rumored Buzz on Insurance

These are a responsibility to the firm as well as not included in written costs or the unearned costs get. - the social phenomenon whereby individuals with a greater than average probability of loss look for higher insurance coverage than those with much less danger. - a group sustained by member firms whose feature is to gather loss data and also publish trended loss prices.- a price quote of the cases settlement connected with a specific claim or cases. - an insurance coverage business formed according to the legislations of an international country. The business should comply with state regulatory requirements to legally market insurance coverage products in that state. - protections which are typically written with building insurance, e.

- an annual report needed to be submitted with each state in which an insurer operates. This report supplies a snapshot of the financial condition of a business and also considerable occasions which took place throughout the reporting year. - the beneficiary of an annuity repayment, or individual throughout whose life and annuity is payable.

Report this wiki page